27+ who does reverse mortgages

Compare Pros Cons of Reverse Mortgages. Homeowners who are over the age of 62 and have either paid off their home loan or have a very small balance which must be paid off upon.

10 Best Reverse Mortgage Lenders Of 2023 Compare Rating Reviews

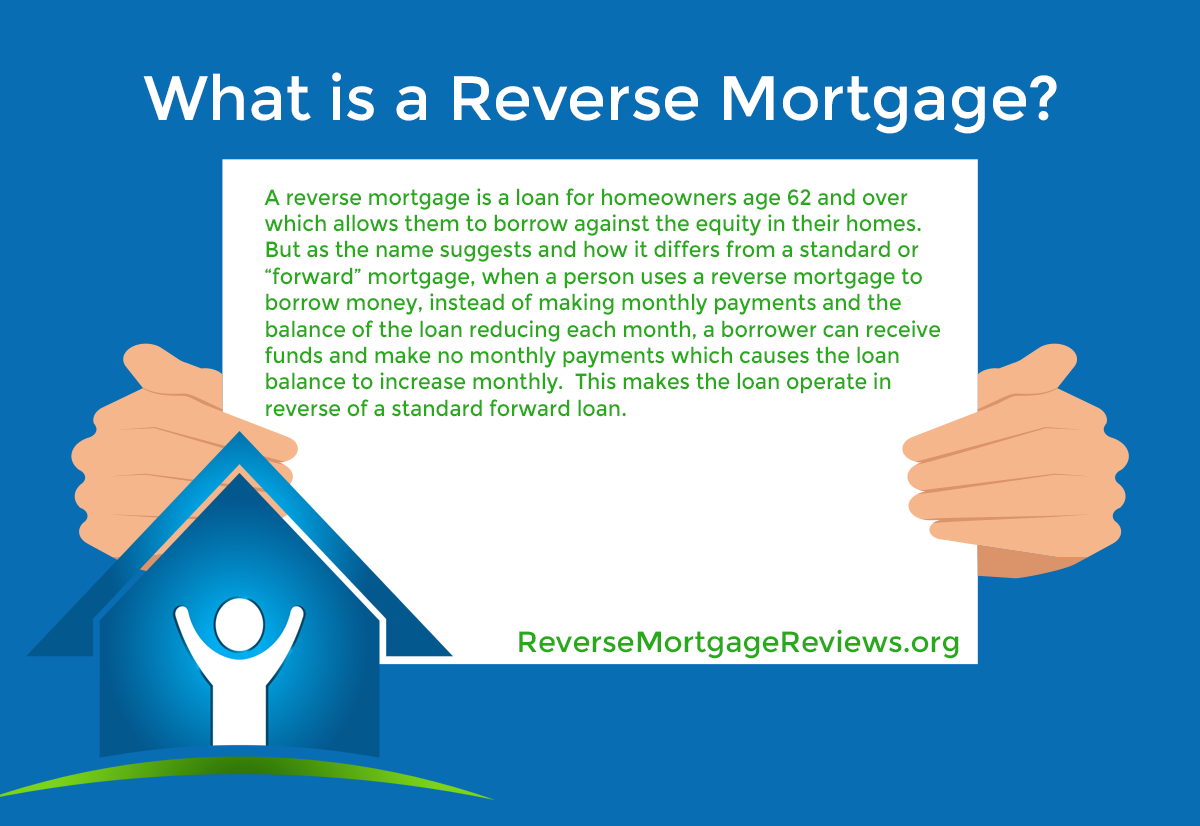

Web A reverse mortgage is a loan for homeowners 62 and up with a large amount of home equity.

. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Free Info Kit For Homeowners Age 61. HECMs proprietary reverse mortgages and single-purpose reverse mortgages.

Web What Is a Reverse Mortgage and How Does It Work. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

In some cases eligible nonborrower spouses may remain in the home. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web A reverse mortgage becomes due when the last borrower dies sells the home or moves out permanently.

Is it right for you now. Some lenders also offer. I would like to know the exact reverse.

Free Info Kit For Homeowners Age 61. Get A Free Information Kit. Web Reverse mortgage is a loan for senior homeowners that allows borrowers to access a portion of the homes equity and uses the home as collateral.

Web Reverse mortgages are loans that enable US. Web 3 Reverse Mortgage Eligibility. Web Some state and local government agencies or nonprofits offer single-purpose reverse mortgages which are the least expensive reverse mortgage option.

And the home must be your primary residence. A type of loan that typically allows homeowners age 62 or older to borrow against the equity in their homes. A reverse mortgage is a financial arrangement that allows homeowners to withdraw equity from their homes.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Homeowners over the age of 62 to cash in on the equity built up in their home via a reverse mortgage lender. First the youngest borrower must be at least 62.

Ad Can the loan improve your emotional and financial well being. Web A Home Equity Conversion Mortgage HECM the most common type of reverse mortgage is a special type of home loan only for homeowners who are 62 and. The homeowner can borrow money from a lender against the value of their home.

Ad Reviewed Ranked. Web Learn what a reverse mortgage is A reverse mortgage is a special type of home loan only for homeowners who are 62 and older. Web Up to 25 cash back Reverse mortgages come in three varieties.

This change will save FHA. With a reverse mortgage the amount the. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web Reverse mortgages can provide a source of income to help fund retirement living expenses. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web Proprietary reverse mortgages have no loan limits unlike HECM loans for 2022 a borrower will receive funds based on a home value of 970800 or less even if.

Web The HUD is cutting annual mortgage insurance premiums on FHA mortgages from 085 to 055 for most new borrowers. It lets you convert a portion of your homes equity into cash. Web Thinking of getting a reverse mortgage.

Reverse mortgages sound like a good ideaafter all who wouldnt want a dream monthly retirement income. Web Not just anyone can get a reverse mortgage. Certain criteria must be met to.

But whether or not a reverse mortgage is a good idea for you will. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Get A Free Information Kit.

Ad Reviewed Ranked. You can use them. The loan generally does.

Web To get a government-backed reverse mortgage called a Home Equity Conversion Mortgage HECM you must be at least 62. Ad Free Reverse Mortgage Information. You cant take out a.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Most reverse mortgages today are called. Web Reverse Mortgage Property Requirements Updated 2023 September 17 2022 By Michael Branson 90 comments.

Web A reverse mortgage is a type of loan for homeowners aged 62 and older.

What Is A Reverse Mortgage Explained In Layman S Terms Reversemortgagereviews Org

Reverse Stock Split Why Does Company Choose To Split Their Stocks

Here Are The Banks That Offer Reverse Mortgages 2023 List

.jpg)

About Jamie

Best Reverse Mortgage Lenders Of 2023 Bankrate

10 Best Reverse Mortgage Lenders Of 2023 Compare Rating Reviews

Reverse Merger Why Do Company S Do Reverse Merger

Reverse Mortgages Mortgage Rates Mortgage Debt Management

Are Reverse Mortgages As Bad As They Say Arrest Your Debt

How Much Can You Borrow With A Reverse Mortgage Ratespy Com

Best Reverse Mortgage Lenders Of 2023 Retirement Living

Reverse Mortgages Know Before You Owe Consumerfinance Gov Youtube

Today S Lowest Reverse Mortgage Interest Rates For Reverse Mortgages Lowest Rates More Money For You Click Quote Save

Best Reverse Mortgage Lenders Of 2023 Retirement Living

:max_bytes(150000):strip_icc()/LongbridgeFinancial-0a928d10228448b7a3c41e6ccc9356bb.jpg)

Best Reverse Mortgage Companies Of 2023

Reverse Mortgages Are Complex Hud Should Make It Easier For Seniors To Compare Them

Banks Offering Reverse Mortgages Retreat